|

TSOP NO: |

8.06 |

|

SUBJECT: |

Common Errors When Submitting Sales Tax KFS Documents for Sales on Behalf of IU |

|

SOURCE: |

University Tax Services - Financial Management Services |

|

ORIGINAL DATE OF ISSUE: |

08/02/2019 GL |

|

DATE OF LAST REVISION: |

8/19/19 samn |

|

RATIONALE: |

To provide Indiana University Departments with instructions on how to avoid the most common errors when submitting KFS document for sales tax. |

|

PROCEDURES: |

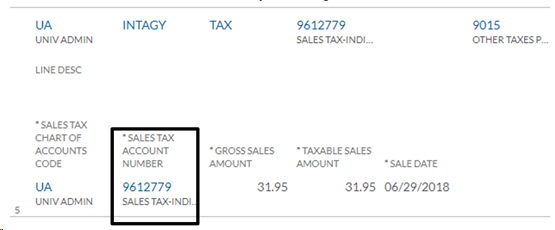

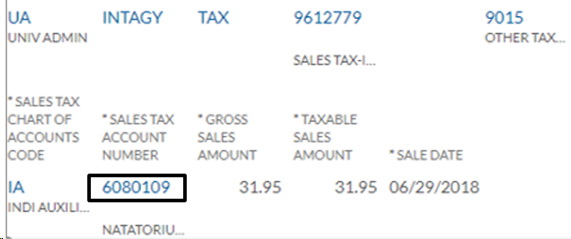

After making a sale on behalf of IU which required collecting sales tax, departments are required to remit that sales tax to University Tax Services, the procedure for which can be found in TSOP 8.01. Below are some common errors we encounter when reviewing these documents, and the correct way they should have been submitted: 1. “Sales Tax Account Number:” Contrary to how it is labeled, this should not be account 9612779. INCORRECT:

It should be the account the money is coming from (most likely your department’s account). CORRECT:

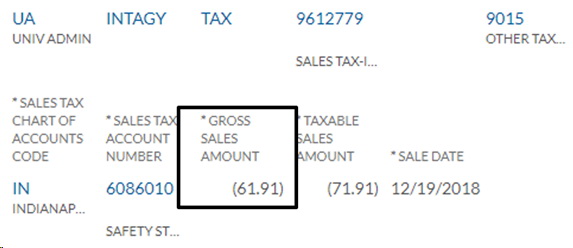

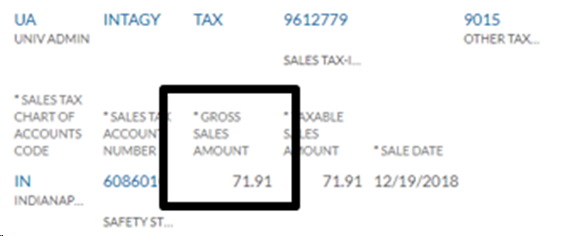

2. “Gross Sales Amount:” This amount should hardly ever be negative. If it is, we need to know why. If an item is returned to a store and a refund is issued, that’s fine (please mention this is the notes of the document. However, if it is an error, it needs to be corrected. INCORRECT:

CORRECT:

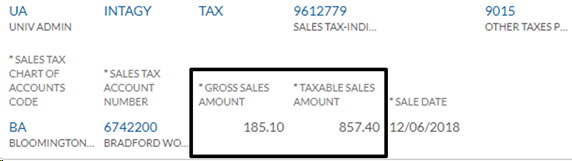

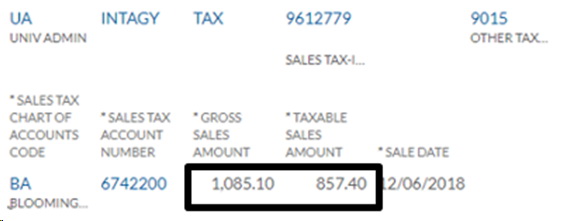

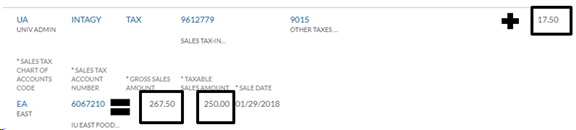

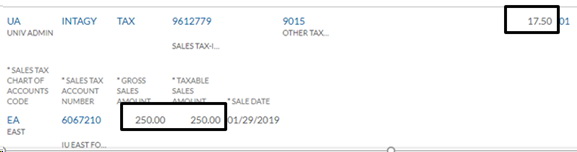

3. Gross Sales Amount vs. Taxable Sales Amount: Taxable sales should never be greater than gross sales. The only exception might be if an item is paid for with a gift card (please mention this in the notes of the document). Otherwise, this is an error that needs corrected: INCORRECT:

CORRECT:

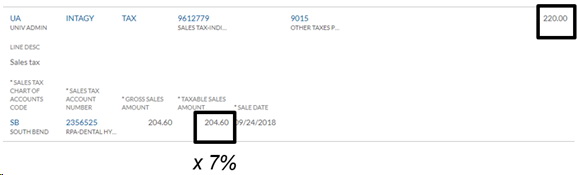

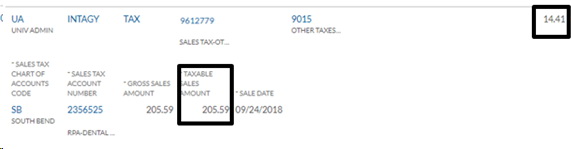

4. Tax due (calculated percentage) vs. Tax Paid (amount entered in document): The tax amount should be 7% of the taxable sales amount (5% for Monroe County Innkeepers Tax, 1% for Monroe County Food and Beverage Tax, etc.). If might be a few cents off due to rounding, but if it’s more than 50 cents, this is an error that needs correcting: INCORRECT:

CORRECT:

5. Gross Sales, Taxable Sales, and Tax Amounts: Occasionally, someone will mistakenly add the tax into the gross sales amount, which is incorrect. Tax collected is not part of gross sales. We will add taxable sales to the tax, and if it exactly equals the gross sales amount, then it is likely an error. It doesn’t have to be, but we will ask the department to confirm. INCORRECT:

CORRECT:

|

|

DEFINITIONS: |

IU Department : Any department with an account in FIS Gross Sales : The sales price of all items sold in a transaction. This amount does NOT include the tax itself. Taxable Sales : The sales price of all items that are subject to sales tax. Or, the sales price of all items other than those exempt from sales tax. |

|

CROSS REFERENCES: |