|

TSOP NO: |

5.02 |

|

SUBJECT: |

Service Component for Student Awards |

|

SOURCE: |

University Tax Services, University Student Services and Systems, Office of Vice President and General Counsel |

|

ORIGINAL DATE OF ISSUE: |

6/13/16 |

|

DATE OF LAST REVISION: |

3/11/2019, 8/12/19 [samn] |

|

RATIONALE: |

The purpose of this standard operating procedure is to provide units and departments with guidance on how to pay students, specifically, when to pay student awards vs. wages. At times, there are awards provided to students that contain a service component, and based on the attributes of the required service, should be reported as wages paid through payroll instead of a student award. This procedure discusses the differences in classifications to assist in the disbursement process per IRS regulations for tax reporting. In order to comply with the Affordable Care Act, the university also has a requirement to track all hours worked by individuals across all possible areas of the university so that appropriate benefits are offered if thresholds are met. As a result, the practice of awarding stipends for work has virtually ended with limited exceptions specifically allowed under the Fair Labor Standards Act. |

|

PROCEDURES: |

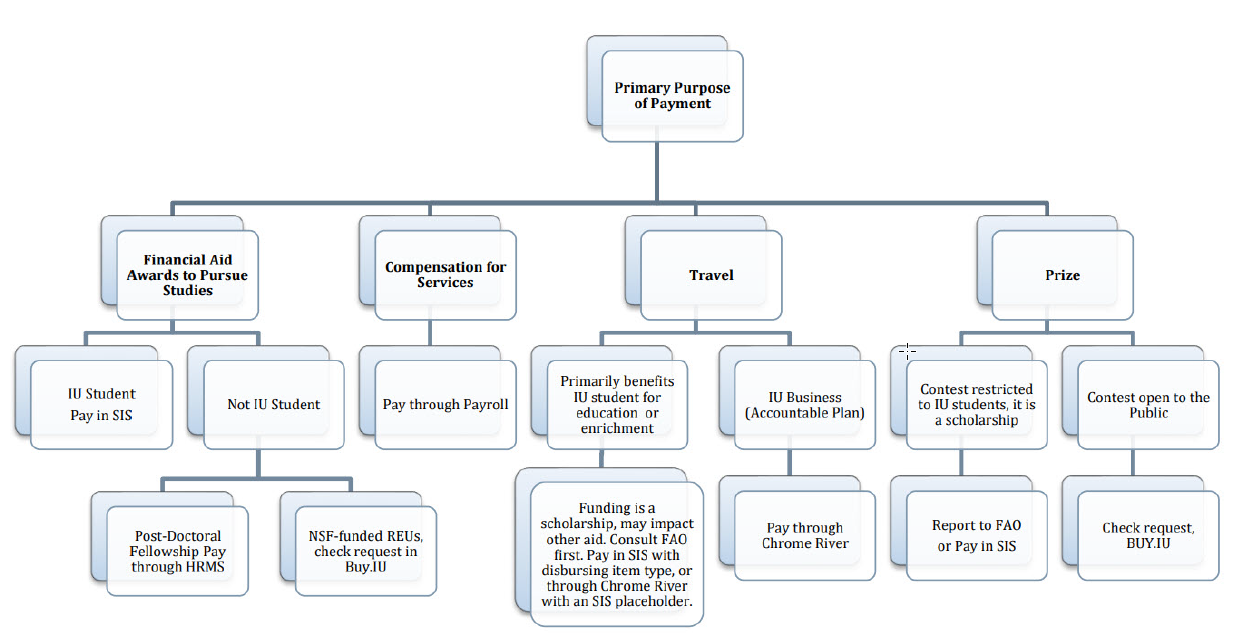

At Indiana University, there are 3 primary channels by which to disburse funds to a student – 1. Student Information Systems (SIS) 2. Human Resource Management System (HRMS) and 3. Buy.IU. For tax reporting, it is crucial that the appropriate channel be used to ensure proper income reporting and form generation per IRS guidelines. In general, SIS is to be used for student financial aid awards to pursue studies, HRMS is to be used when services are performed at the direction and control of the university or employee business reimbursements and Buy.IU is to be used to reimburse a non-employee for out-of-pocket IU business expenses (see Accountable Plan webpage) or to pay an independent contractor (non-employee) for services. Buy.IU is only appropriate for payments to students in very rare circumstances. Because situations are not always straightforward, the information below should help in assisting which channel is appropriate for the payment. SIS Payments : · Payments made when primary purpose is to aid in study, training or research · IU does NOT provide oversight in the study or research; however, faculty may provide guidance to student · Not associated with past, present or future services · Typically paid in advance with no expectation of funds to be returned · No employer control/employee relationship HRMS Payments : · Services to aid in IU’s mission of teaching, research or public service · University has direction and control or supervision over the individual · The individual has a defined work-week and/or schedule · Receipt of the funding is contingent upon teaching, research or performance of other services Buy.IU Payments : · Reimbursements to individuals for out-of-pocket expenses incurred on behalf of IU business (see Accountable Plan webpage) · Payments made to Independent Contractors who have direction and control of schedules, performance and other applicable attributes (see Independent Contractor vs. Employee Determination webpage) · Travel for IU business purpose, not personal enrichment for students The flowchart below has been created to assist in the disbursement of funds decisions to be made for payments.

Scholarships with Service Component : Scholarships that contain a service component should be reviewed by the applicable financial aid offices to determine whether funds should be disbursed as student awards or wages – see above documentation for distinctions and questions below for assistance in determination. Please review the questions below to assist on determining service scholarship vs. wage – if the answer is YES to ANY question below, then process as wages through HRMS as compensation to an employee: 1. Is the university the primary beneficiary of the services? There may be mutual benefit between the student and IU for the services, but if the primary purpose of services performed is not education for the student, it is more for the university’s benefit. If the student is the primary beneficiary, this should be clearly stated and documented in the award letter for substantiation. - If YES – pay through payroll as employee wages. - Example: Student is required to lead campus tours two days a week for potential students and visiting parents. This is plausible for perhaps a Tourism and Hotel Management scholarship, but not for a Biology student award. The service component should be related to the student’s pursuit of study here at IU and related to the course of study; otherwise, IU is primarily benefiting from the services, not the student. OR 2. Would anyone be chosen without merit (any other student or employee) to complete the services if the first student was unable to perform or complete the task? If someone would need to be identified to perform the services or task, this most likely primarily benefits IU should be paid as employee wages. - If YES – pay through payroll as employee wages. - Example: Student is required to tutor fellow students 10 hours a week in a subject related to student’s studies and the tutoring schedule (hours/days of week) is set by the department. If student is not able to complete, an hourly employee would be hired to tutor students in the same capacity. In this case, the award should be employee wages. OR 3. Are all students who receive this award required to perform the services on a quid pro quo (contingent) basis? If payment is contingent upon future or current services to be performed, the services are considered compensation for wages. Scholarships by their nature are not conditional (other than in the academic sense) or they should be considered wages. - If YES – pay through payroll as employee wages. - Example: Student is required to assist professor in research activity and will only receive award as research is completed throughout the semester. Since payment is conditional upon completion of services, this is considered compensation as wages paid to employee. NOTE: Alternatively, there could be an example where the student must meet certain academic conditions (such as a certain GPA) and that would not be considered services to be performed. If, in the course of reviewing these questions, there is a determination of a legitimate service component of the award by the campus financial aid department, clear documentation should be included with the award to explain why this service piece is adding to the STUDENT’S pursuit of study. Questions : Tax : If questions arise as to the tax treatment of payments please contact University Tax Services at taxpayer@iu.edu with any questions. Financial Aid : if questions arise as to when something is classified as a scholarship and paid through SIS, please contact your campus financial aid department. |

|

DEFINITIONS: |

SIS: Student Information System HRMS: Human Resource Information System |

|

CROSS REFERENCES: |