|

TSOP NO: |

3.08 |

|

SUBJECT: |

Free or Discounted Housing Provided by IU |

|

SOURCE: |

University Tax Services |

|

ORIGINAL DATE OF ISSUE: |

3/1/2019 (IJ) |

|

DATE OF LAST REVISION: |

3/14/19 (CA), 4/8/19[samn] |

|

RATIONALE: |

The purpose of this Tax Standard Operating Procedure [TSOP] is to provide IU units with guidance regarding free or discounted lodging given to employees, students or any other individuals who have an affiliation with IU, either on or off campus. The taxability of these benefits varies depending on whether certain conditions are met. In general, free or discounted housing that is not primarily for IU business purpose, like other fringe benefits, is included in taxable income to the individual. If the lodging is provided under conditions that meet the “excludable lodging” provisions in Section 119(a) of the Internal Revenue Code (the Code) and Section 1.119-1 of the Treasury Regulations, then it can be excluded from taxable income. If the lodging does not meet these conditions, it could still be exempted from taxable income if the circumstances satisfy the “qualified campus lodging” provisions in Section 119(d) of the Code. See further details below. Please note it is the responsibility of the unit/department to be familiar with the issues discussed in this TSOP when providing free or reduced housing and the department is accountable in the case of an IRS audit for ensuring sufficient documentation is in place. |

|

PROCESSING INSTRUCTIONS: |

|

|

DISCUSSION: |

If the recipient of the free or discounted is a(n): STUDENTIf the housing is being provided to a student, units should review the Indiana University Student Payment Guidelines to ensure no breach in policy will occur. These guidelines provide more details on how to make the payments. This document can also help units determine the potential impact on the student employee’s financial aid. According to the Compensation for Services section, it is not appropriate to use nonmonetary forms of compensation (such as a free trip, tangible item, campus housing or meals) in lieu of hiring a student for services performed for the university. Additionally, USSS-09, a University-wide policy document on reduced room and board for student employees should be reviewed to ensure no guidelines are violated. Please see the Examples below and contact taxpayer@iu.edu with any questions on your specific instance. EMPLOYEEIn general, free or discounted housing provided to an employee will be considered taxable income unless a specific exclusion applies. The flowchart below provides a summary of the regulations and the relevant decision process regarding the two main exclusions. Please see the Examples section below also and contact taxpayer@iu.edu with any questions on your specific instance. The Internal Revenue Code and applicable Treasury Regulations allow the exclusion of lodging from taxable income under three different circumstances: 2. When lodging is provided under circumstances that satisfy the "excludable lodging" provisions in Section 119(a) of the Code and Section 1.119-1 of the Treasury Regulations; or 3. When lodging is provided under circumstances that satisfy the "qualified campus lodging" provisions in Section 119(d) of the Code. 4. When lodging is provided for temporary work assignments. §119(a) AND §1.119-1In order to meet the first exclusion, all three of the following requirements must be met:

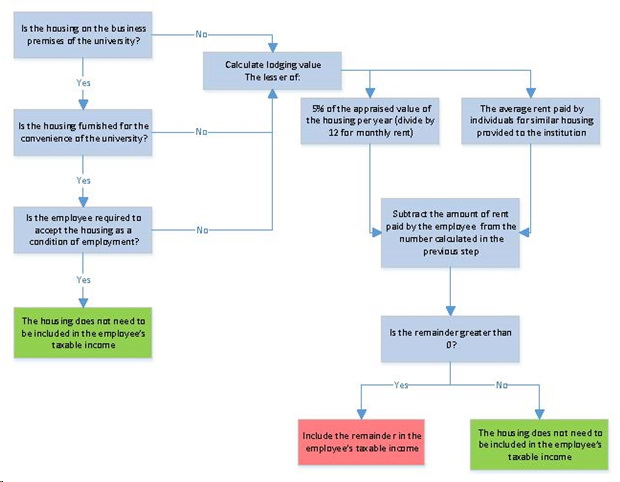

Only if all three of these requirements are met, then the housing can be excluded from taxable income. If these requirements are not met, the exclusion under Section 119(d) of the Code can be tested as follows. §119(d)This exclusion states that, in general, gross income of university employees shall not include the value of qualified campus lodging furnished to such employee during the taxable year. However, when the employee pays “inadequate rent” for this lodging, the remaining portion of the value of the housing is considered taxable income. The amount that must be reported as taxable income, if any, is calculated by subtracting the amount of rent paid from the lesser of: (i) 5% of the appraised value of the housing per year (divide by 12 for the monthly rate), or (ii) The average rent paid by individuals for similar housing provided by the institution. TEMPORARY JOB ASSIGNMENTSIf an employee is temporarily relocated, employer provided housing is not taxable to the employee. In order to be excluded from taxable income, the following conditions must be met: · The employee must be traveling away from their regular place of business. The regular place of business can encompass the entire city or metropolitan area where the business is located. · The assignment must be expected to last one year or less. VALUATIONIf none of these exclusions are met, the fair rental value of the housing must be recorded as income taxable to the employee. This means the average rent paid by individuals for similar housing provided by the institution. Generally, this will be added to payroll as a noncash fringe benefit or as supplemental pay. FLOWCHART FOR employer provided housing:

Individuals with IU affiliation:Similar to employees and students, free or reduced housing provided to an individual with an affiliation to IU should also be evaluated for taxability. For these instances, units & departments should be familiar with IU policy FIN-ACC-I-620 Reimbursement Under the Accountable Plan and UCO-TAX-6.01: Expenditures: Expenses and Reimbursement Under the Accountable Plan which discuss the need for expenses incurred by the university to have a primary business purpose in order to not be considered taxable, reportable income. If the housing is provided in lieu of monetary compensation or as a benefit to the individual, it will likely not meet the exclusion for taxability. Please see the examples below and contact taxpayer@iu.edu with any questions on your specific instance. |

|

EXAMPLES: |

SCENARIO set 1: students & Student employeesThese scenarios pertain to students performing various jobs for the university and receiving free or reduced-price housing in exchange. Under this scenario, a determination should be made first to determine if the payments are in accordance with the student payment guidelines. Next, the applicable exclusions should be tested to see if the value of the housing should be included in the employee’s taxable income or not. EXAMPLES:

SCENARIO 2: Employees - PROFESSORS, staff, & facultyThese scenarios pertain to various staff, faculty, and professors being provided housing or lodging by the university [being paid directly or indirectly]. The applicable exclusions should be tested to see if the fair value of the housing should be included in taxable income. If none of the exclusions are met, the fair rental value of the housing should be included in taxable income. There are no regulation-specific differences between student employees and professors, staff, & faculty regarding this issue. EXAMPLES:

SCENARIO 3: Other individuals with iu affiliationThe following scenarios apply to other individuals with an affiliation to Indiana University that receive free or discounted housing. Units should first ensure that all applicable accountable plan guidance is followed before determining whether the housing benefit is taxable to the employee. If any of the accountable plan policies indicate that the payment is taxable, the fair rental value of the housing should be included in the individual’s taxable income. Units must be aware that foreign nationals may have a mandatory withholding. Please refer to "https://fms.iu.edu/tax/international/nonresident-vs-resident/" this page and contact University Tax Services at taxpayer@iu.edu for additional assistance. EXAMPLES:

LEGEND:

|

|

DEFINITIONS: |

Fair Rental Value : The average rent paid by individuals for similar housing provided by the institution. All facts and circumstances, such as included furnishings, should be taken into consideration. Fringe Benefits : Extra benefits supplementing an employee’s salary, such as car service, subsidized meals, gym memberships, etc. Qualified Campus Lodging (in reference to §119(d)) : Lodging where §119(a) does not apply, which is located on, or in the proximity of, a campus of the educational institution, and which is furnished to the employee, their spouse, and any dependents by or on behalf of such institution for use as a residence. Inadequate Rent (in reference to §119(d)) : When the paid rent amount is smaller than the lesser of 5% of the appraised value of the housing per year (divided by 12 for monthly), or the average rent paid by individuals for similar housing provided by the institution. Temporary Job Assignment : The employee must be travelling away from their regular place of business for an expected period of one year or less. Accountable Plan Primary Benefit : Clarifies that the primary benefit must be to Indiana University to qualify as exempt. However, this does not mean that mutual benefit cannot exist. There will often be some degree of mutual benefit, but the fact that the primary benefit is to Indiana University is what matters most. |

|

CROSS REFERENCES: |

USSS-09 - Reduced Room and Board for Student Employees FIN-ACC-I-620 Reimbursement Under the Accountable Plan UCO-TAX-6.01: Expenditures: Expenses and Reimbursement Under the Accountable Plan |