Prerequisites

It is beneficial to review the below IU Accounting Standards sections to gain foundational information:

- Accounting Fundamentals Standards Section

- Chart of Accounts & General Ledger Standards Section

- Financial Statements Standards Section

- Unallowable Expenses for Recharge/Service Centers

Preface

This standard provides guidance to recharge/service centers on how to allocate costs to internal and external activities.

Introduction

Recharge/service centers are units within Indiana University that furnish goods or services to other IU departments for the convenience of the university and charges a fee directly related to the costs for providing the goods or services. All recharge centers are expected to recover no more than the aggregate costs of their operations through charges to users.

To comply with Uniform Guidance, units that want to bill for goods or services provided to other university units, or within their own unit, may only do so with an approved recharge rate(s) on file with the Office of the University Controller (UCO). A recharge/service center can only recover allowable costs when billing other university accounts. If recharge/service activity is co-mingled with external activity, the total cost of the activity must be analyzed and allocated between external 60* accounts and internal 66* accounts. Any unallowable costs must be completely funded by an account other than the internal 66* account, even if the cost is incurred by the recharge/service activity.

Any allowable direct costs that are specifically identifiable and are associated entirely with the internal activity should be fully funded by the recharge/service 66* account.

Importance and Impact of Recharge Rate Cost Allocations

Recharge operations may be subject to federal and non-federal audits of sponsored programs. As a recipient of federal funding, the university must comply with Uniform Guidance Requirements, Cost Principals and Audit Requirements for Federal Awards. Uniform Guidance requires that service units charge according to actual usage at nondiscriminatory rates calculated to recover no more than the actual costs of the service provided (§200.468). Non-compliance could harm the university’s reputation, reflect negatively on future award proposals and could also lead to repayments or fines to the government.

Allocation of External Costs

Costs that are shared by both external and recharge/service activity must be allocated between the internal (66*) account and external (60*) account. The allocation method used must be based on the benefits received or other such equitable or logical association. The department should determine and document the allocation method. The allocation documentation should be retained by the department for audit or other purposes.

The basis for the allocation method should correspond to the type of expense. Examples of acceptable allocation methods include:

The allocation should not be made based on percentage of revenue.

Requirements and Best Practices

Requirements

- Recharge/service centers should review cost allocations on an annual or biennial basis based on Rate Submission Requirements for Recharge Centers standard to confirm the allocation method used is appropriate.

Best Practices

- Fiscal officers should continuously monitor the fund balance on recharge accounts to confirm the cost allocation method used is appropriate and the fund balance is not becoming a significant deficit or surplus.

Detailed Allocation Examples

Costs that are shared by recharge/service centers and other accounts or external activity must be allocated.

1. Salary

Examples of Allocation Methods for Salary & Wages:

A. Use of a Recharge/Service (66) Account for All Salary & Wages

In order to preserve a central administrative account for budget purposes, a recharge/service center activity may elect to budget all of salary and wages for both internal and external activity in a (central payroll) recharge/service (66) account within their organization. The recharge/service center would then bill other internal and external accounts for their proportionate usage of salaries and wages using an internal billing. The billing organization must use an expense object code that reports to the S&E object level.

The development of your rate for salary and wages can be a single pooled rate or a tiered pooled rate.

- With a single pooled rate, all of the salaries, wages and benefits associated with the recharge activity are summed to get total compensation. The total compensation figure is then divided by the total anticipated labor hours of everyone in the pool. This method should only be used when the salaries in the pool are comparable.

- With a tiered pooled rate, the salaries and benefits associated with the recharge activity are grouped together by type of employee and a rate is calculated for each tier. The salaries, wages, and benefits in a given tier are summed together to get total compensation for that tier. The total compensation for a given tier is then divided by the anticipated labor hours worked by employees in the tier.

All allocation methods and percentages should be reviewed by the department at least annually and modified for significant changes.

Examples of pooled rates, can be found on S&W Rate Allocation Example.

B. Updating Job Funding for Each Employee Based on an Allocation

On an annual basis, the recharge/service activity could evaluate the percentage of time each employee spends on internal and external activities. Once they have a reasonable and documented allocation method, the department could update the job funding for the employee so that the internal and external accounts each reflect the allocated amount of salary, based on historical effort, for a given pay period. Any significant changes throughout the year would require that the job funding be updated accordingly.

C. Initiating Salary Transfers for a Given Employee for a Pay Period

The Salary Transfer (ST) document is used to move salaries and associated staff benefit charges for a given employee for a particular account period (or set of periods) from one or more accounts to another account (or set of accounts) after payroll has posted to the labor ledger.

Summary of Options:

The chart below outlines the primary differences in the options listed above.

| Item | 1. Payroll Recharge Account | 2. Job Funding | 3. Salary Transfer |

|---|---|---|---|

| Budget & Actual Expense Are Recorded in Same Account | Yes | Yes | No |

| Requires Subsequent Entries (i.e. internal billing or individual salary transfers) | Yes | No | Yes |

| Requires Subsequent Entries for Each Employee and Pay Period | No | No | Yes |

2. Square Footage

A unit rents space to other university departments as well as some external customers. The square footage rented to each customer is listed below:

| Rented to Campus Department A: | 35,000 square feet |

| Rented to Campus Department B: | 5,000 square feet |

| Rented to Campus Department C: | 70,000 square feet |

| Rented to External Customer 1: | 26,000 square feet |

| Rented to External Customer 2: | 4,000 square feet |

| Internally used space | 60,000 square feet |

| Total square feet rented | 200,000 square feet |

| Square feet rented to campus | 110,000 square feet |

55% of the square feet is rented to other campus departments. This percentage could be used to allocate expenses (ex: utilities, security, repairs and maintenance, etc.) to the recharge/service center 66 account. These expenses should be moved via KFS Distribution of Income/Expense (DI) document. Another option would be to split-fund purchase orders for the expenses based on the allocation percentage (55% to the 66 account and 45% to the 60* account).

If there is debt service associated with the rented building, please contact UCO Capital Assets at capasset@iu.edu for further guidance.

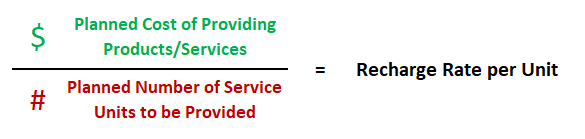

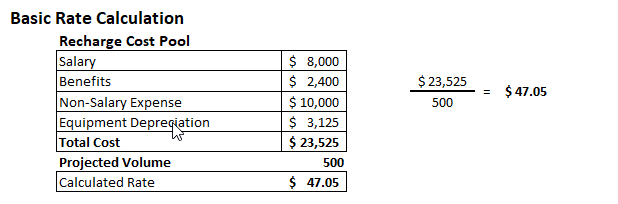

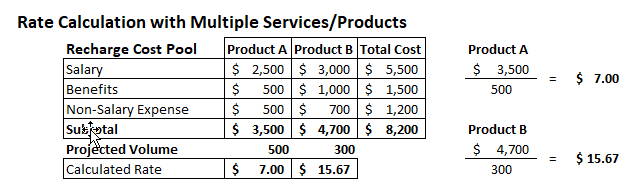

3. Number of Units

A department provides a single lab service to other Indiana University departments. The total cost(s) associated with providing the service are divided by the number of units to calculate a price per unit.