Prerequisites

Prior to reading the standard Normal Balances, it is beneficial to review the below sections to gain foundational information:

- Roles and Responsibilities Section

- Accounting Fundamentals – Accounting Terminology Section

- Accounting Fundamentals – Accounting Principles Section

Preface

This standard discusses fundamental concepts as they relate to recordkeeping for accounting and how transactions are recorded internally within Indiana University. Information presented below walks through specific accounting terminology, debit and credit, as well as what are considered normal balances for IU.

Introduction to Normal Balances

What are Debits and Credits?

Entities make financial transactions on a day-to-day basis in order to continue running business operations. When accounting for these transactions, two entries must be made: a debit and a corresponding credit.

Debits and credits are what make up journal entries in a general ledger. Debits and credits either increase or decrease the following accounts: asset, liability, fund balance, revenue, and expense. The following chart shows the direction of debits and credits in various accounts as well as each account’s normal balance.

| Account | Normal_Balance | To_Increase | To_Decrease |

|---|---|---|---|

| Assets | Debit | Debit | Credit |

| Liabilities | Credit | Credit | Debit |

| Fund Balance | Credit | Credit | Debit |

| Revenues | Credit | Credit | Debit |

| Expenses | Debit | Debit | Credit |

Debits and credits differ in accounting in comparison to what bank users most commonly see. For example, when making a transaction at a bank, a user depositing a $100 check would be crediting, or increasing, the balance in the account. But for accounting purposes, this would be considered a debit. While the two might seem opposite, they are quite similar. Breaking down the above example of depositing a $100 check from both perspectives - banking and accounting, users can see, that while it appears as a “credit” to the user depositing the check, it is really just the bank’s off-set to the receipt of the check.

What are Normal Balances?

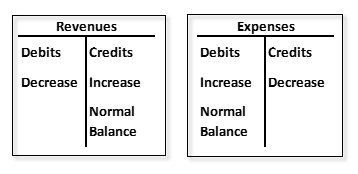

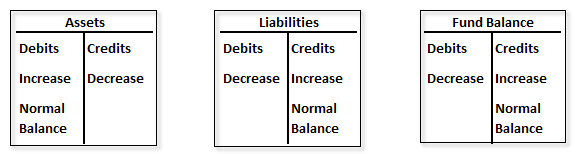

To better visualize debits and credits in various financial statement line items, T-Accounts are commonly used. Debits are presented on the left-hand side of the T-account, whereas credits are presented on the right. Included below are the main financial statement line items presented as T-accounts, showing their normal balances.

Income Statement T-Accounts:

A normal balance is the side of the T-account where the balance is normally found. When an amount is accounted for on its normal balance side, it increases that account. On the contrary, when an amount is accounted for on the opposite side of its normal balance, it decreases that amount.

Balance Sheet T-Accounts:

Within IU’s KFS, debits and credits can sometimes be referred to as “to” and “from” accounts. These accounts, like debits and credits, increase and decrease revenue, expense, asset, liability, and net asset accounts.

Debit and Credit Examples

Below is a basic example of a debit and credit journal entry within a general ledger.

This general ledger example shows a journal entry being made for the collection of an account receivable. Because both accounts are asset accounts, debiting the cash account $15,000 is going to increase the cash balance and crediting the accounts receivable account is going to decrease the account balance. When we sum the account balances we find that the debits equal the credits, ensuring that we have accounted for them correctly.

To show how the debit and credit process works within IU’s general ledger, the following image was pulled from the IUIE database. Employees who are responsible for their entity’s accounting activities will see a file such as the one below on more of a day-to-day basis. This general ledger example shows a journal entry being made for the payment (cash) of postage (expense) within the Academic Support responsibility center (RC).

This transaction will require a journal entry that includes an expense account and a cash account. Note, for this example, an automatic off-set entry will be posted to cash and IU users are not able to post directly to any of the cash object codes. Because postage was purchased for $12.70, cash, an asset account, will be credited, which will decrease the cash balance by $12.70. Contrarily, purchasing postage is an expense, and therefore will be debited, which will increase the expense balance by $12.70. When the account balances are summed, the debits equal the credits, ensuring that the Academic Support RC has accounted for this transaction correctly.

Requirements and Best Practices

This section outlines requirements and best practices related to Accounting Fundamentals – Normal Balances. While not required, the best practices outlined below allows users to gain a better picture of the entity’s financial health and help identify potential issues on a more frequent basis. This allows organizations to identify errors, mistakes and pitfalls which can be remedied quickly and prevent larger issues in the future.

Requirements

- Review all the Normal Balances standard listed within the document to gain pertinent knowledge of accounting at IU. After reviewing, if users have questions, reach out to the campus office or the Accounting and Reporting Services team at uars@iu.edu.